are funeral expenses tax deductible in 2020

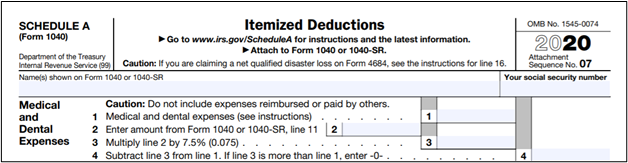

Tax law changes for 2022. The cost of eye exams contact lenses lens solution and cleaner and prescription eyeglasses including sunglasses is deductible assuming your insurance.

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

Allowable expenses using the simplified method.

. According to the 2020 NFDA Cremation Burial Report the 2020 cremation rate is projected to be 56 and is projected to reach over 63 by 2025. A motor vehicle except a hearse you bought to use in a funeral business to transport. Health Reimbursement Account - HRA.

If the corporation is using the California computation method to compute the net income enter the difference of column c and column d on Schedule F line 17. Insurers use actuarial science to determine the rates which involves statistical analysis of the various characteristics of drivers. As more consumers choose cremation prices will continue to increase.

By contrast a pre-paid funeral plan requires you. In general for taxable years beginning on or after January 1 2015 California law conforms to the Internal Revenue Code IRC as of January 1 2015. References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code RTC.

If youre wondering Are funeral expenses tax deductible youre not alone but unfortunately a ccording to IRS. 2021-48 and for what tax year 2020 or 2021 as applicable. John properly filed his 2020 income tax return.

Funeral expenses - Expenses for funerals are not reimbursable. Carryover of unallowed expenses from a prior year that are not allowed in 2021. Go to school or do research.

First home super saver scheme To help you save for your first home you can apply to release voluntary concessional before-tax and voluntary non-concessional after-tax contributions you have made to your super fund since 1 July 2017. The expenses are deductible only if the child was under 16 years of age or had an impairment in physical or mental functions at some time in 2021. Line 20a Taxable income.

An HRA or health reimbursement account consists of employer-funded plans that reimburse employees for incurred medical expenses that are not covered by the. Contributions to an ABLE account are not tax deductible and must be in cash or cash equivalents. Enter the nature of the tax the taxing authority the total tax and the amount of the tax that is not deductible for California purposes on Form 100 Side 4 Schedule A.

A statement that the corporation is applying or applied section 3011 2 or 3 of Rev. Every state has a different minimum coverage requirement making auto insurance coverage more expensive in some states than others but they remain lower. Under legislation enacted by the General Assembly Virginias date of conformity to the federal tax code will advance to December 31 2021.

These guidelines relate to expenses currently allowed and not allowed by the Internal Revenue Service as. 2020 Tax Rate Schedule. If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return.

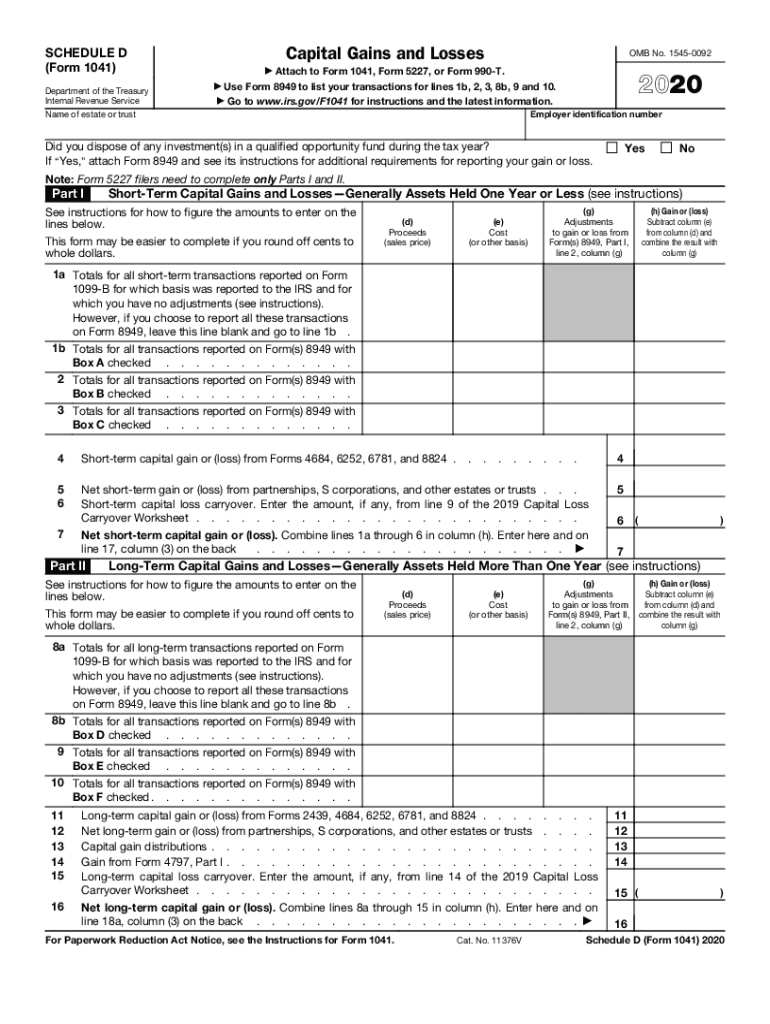

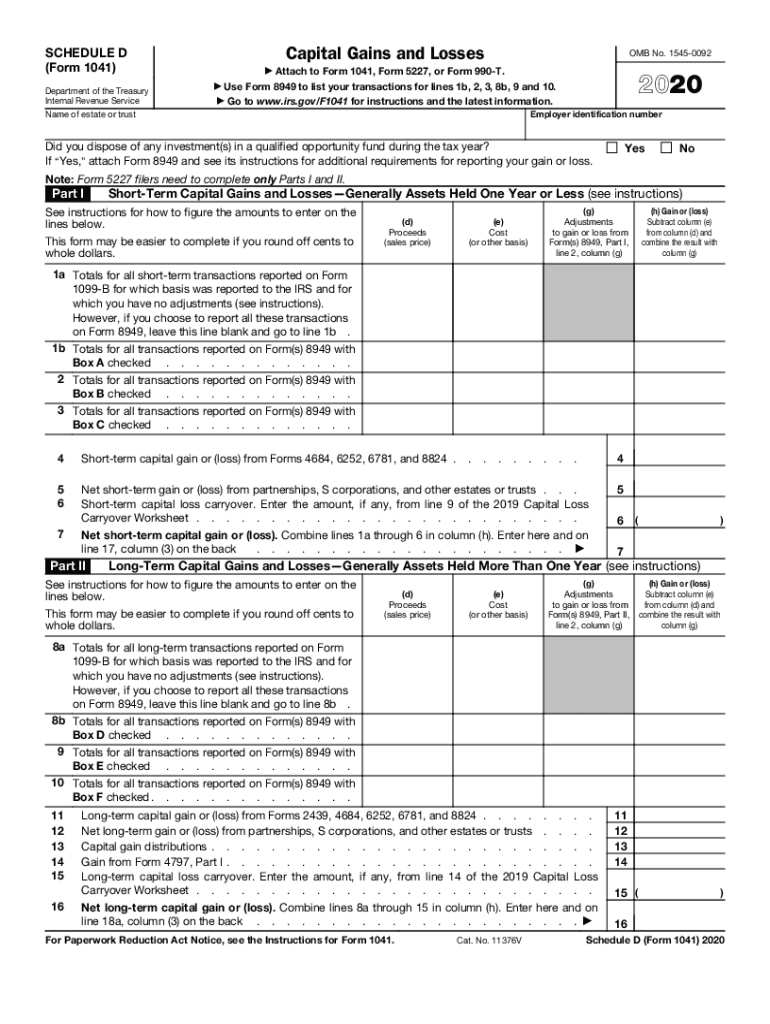

Subtract line 18 income distribution deduction from the adjusted total income reported on line 17 and enter the result. Pays for itself TurboTax Self-Employed. According to Swiss Re of the 6287 trillion of global direct premiums written worldwide in 2020 2530 trillion 403 were written in the United States.

The amount of tax-exempt income from forgiveness of the PPP loan that the corporation is treating as received or accrued and for which tax year 2020 or 2021. These deductions include the debts owed by reason of the decedents death which includes funeral expenses as well as attorney and court fees and any other fees associated with the administration of the estate. The deductions also include.

He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021. If the expenses are paid within the 1-year period his survivor or personal representative can file an amended return for 2020 claiming a deduction based on the 1500 medical expenses. No tax is payable when accessing super accounts with a balance less than 200.

Actual results will vary based on. Over-the-counter medicines and drugs - Effective January 1 2020 expenses are generally reimbursable unless used for general well-being or for purely cosmetic purposes. Insurance generally is a contract in which the insurer agrees to compensate or indemnify.

Debts owed at the time of death or as of the date of calculation. A lump sum payout to help cover funeral costs and other immediate expenses. Enter the smaller of line 1 or line 4 here and include that amount on Schedule C line 30.

For example if youre a federal employee participating in the premium conversion plan of the Federal. You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms. Medical Expenses and Income Tax Folio S1-F1-C1 Medical Expense Tax Credit.

Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. If the amount on Form 541 line 20a is. In addition to the deductions below Virginia law allows for several subtractions from income that may reduce your tax liability.

For the 2020 and 2021 tax years youre allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your dependentsbut only if they exceed 75 of. Enter the amount from your last Form 8829 line 43 line 42 if. 2020 Instructions for Form 565 Partnership Return of Income.

Enter the nature of the tax the taxing authority the total tax and the amount of the tax that is not deductible for California purposes on Form 100W Side 4 Schedule A. Eye- and ear-related conditions. A motor vehicle you bought to use more than 50 as a taxi a bus used in the business of transporting passengers or a hearse in a funeral business.

If zero or less enter -0-5. If the corporation is using the California computation method to compute the net income enter the difference of column c and column d on Schedule F line 17. 100 paid to you if you are diagnosed with a terminal illness 1 Claims are paid out tax-free and usually within 1 business day of completed claim documents being received so your loved ones get financial support when they need it.

Funeral insurance is a guaranteed product that provides financial assistance to your family when you pass away. Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100 business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023. A motor vehicle you bought to sell rent or lease in a motor vehicle sales rental or leasing business.

The money can be used to pay for your funeral or any other expenses as soon as they arise. Insurance in the United States refers to the market for risk in the United States the worlds largest insurance market by premium volume. The automobile insurance market in the United States is a 308 billion US dollar market.

Enter deductible attorney accountant and tax return preparer fees paid for the estate or the trust. See Tax Bulletin 22-1 for more information. The amount does not exceed the actual funeral expenses.

Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement. And wellness financial management administrative services legal fees expenses for oversight and monitoring and funeral and burial expenses.

What Is Sepsis Sepsis Alliance

Irs 1041 Schedule D 2020 2022 Fill Out Tax Template Online Us Legal Forms

Amber Wedding Seating Chart Template Printable Seating Etsy Seating Chart Wedding Template Seating Chart Wedding Wedding Posters

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Are Funeral Expenses Tax Deductible It Depends

Are Funeral Expenses Tax Deductible It Depends

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Covid 19 Funeral Assistance Mema

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Irs Issues Proposed Regulations On Trust And Estate Deductions

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Which Expenses Are Deductible In 2020

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Notre Dame Schools Seasons Annual Report Fall 2020 By Ndschools Issuu

Solved Solve The Following Problems Base On The Business Taxation Laws Of Course Hero

2020 Final Wrap Of 111th General Assembly Tennessee Senate Republican Caucus